The first-of-its-kind card designed especially for your parents in India, so you can empower their health, savings and happiness all the way from the UK.

Take better care of your parents in India

The only card for your parents in India with free healthcare benefits and curated savings from India’s top companies.

Now managed by you!

The all-in-one card

they deserve

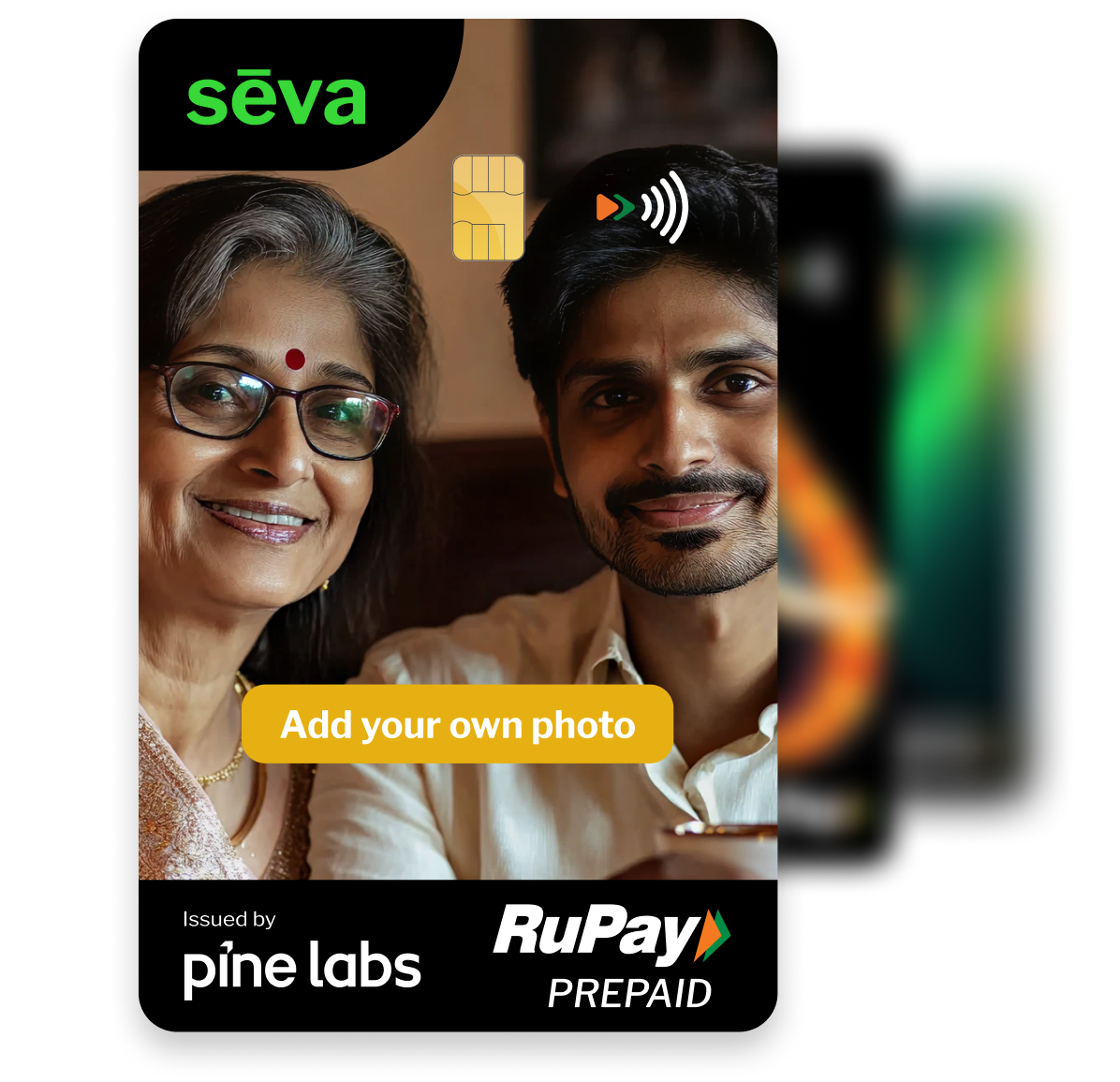

- A personalised photocard they will love

- Instant and free top ups

- 8% cashback on medical spends

- Emergency helpline

- Hospital cash cover

- Same-day specialist consults

- Diagnostic & pharmacy discount

- Balance alerts for you

- More..

Free healthcare and discounts preloaded on the card

In an emergency, Seva’s 24×7 emergency line provides peace of mind, connecting your parents to an ambulance. We keep you updated every step of the way, ensuring they are never alone.

Give your parents 60 free consultations annually, connecting them with leading specialists across India for a wide range of medical needs, all from the comfort of their home.

Hospital bills can be a burden, even with insurance. ₹10,000 per day of hospitalization for up to 15 days, cutting expenses by ₹150,000! Available even with pre-existing conditions and up to the age of 90.

Up to 50% off diagnostic tests and radiology. With trusted partners like Healthians and Tata 1mg, your parents get convenient and reliable care without the high costs.

Up to 20% off all pharmacy spends, from daily prescriptions to urgent medicines, through our partnerships with leading pharmacies like Tata 1mg and PharmEasy.

When they pay for any health service or product, they get 8% cashback into their account. It’s a savings account for their commitment to health.

A dedicated professional who visits your family for 2 hours every month. They offer reliable, compassionate support, bridging the distance with practical help and a friendly face.

Free extensive annual blood tests, as well as complimentary dental and eye check-ups, empowering you to stay ahead of any potential illness and ensure their wellbeing.

Prioritize their wellbeing with daily online yoga sessions. With classes, available every morning at 8AM, we make it easy for them to reduce stress and foster a healthier lifestyle from the comfort of home.

Three Simple Steps to Complete Family Protection

Order your personalised photo card

Set up your subscription in minutes

Parents receive and activate the card

We guide them through quick activation

They enjoy benefits, you enjoy peace of mind

Healthcare, Savings and Alerts – all included.

I give my mum 60 free, same-day specialist consults. Do you?

Now you can too with Seva Money.

Send more than money. Send Seva.

One Price.

Complete Protection.

Unbeatable value, cancellable at any time. Seva Money gives your parents access to top-tier benefits for a fraction of what you spend streaming.

Seva Stories

Send more than money.

Send Seva.

Everything You Need to Know

How does Seva combine money transfer with healthcare?

Seva provides your family with a RuPay card for instant money access AND comprehensive healthcare coverage through the same subscription. The card works for daily spending, while our healthcare network provides medical support. It’s two essential services seamlessly integrated.

How quickly can my family access money?

Top-ups are instant but in exceptional circumstances may take a minute or two at max. Once you top-up the Seva Card, your family can almost immediately use their balance at any ATM or store in India where RuPay cards are accepted. No waiting time, no processing delays.

Your parents would be able to easily top-up their card too through the Seva Card app using UPI, Netbanking or any Indian Bank card.

What healthcare services are actually included?

Complete coverage including specialist consultations (5 per month), 24/7 multilingual emergency helpline, hospital cash (₹10,000 per day of hospitaization), up to 50% discount on diagnostics including radiology and 20% discounts on medicines. Plus companion services for medical appointments.

Annual subscribers get additional benefits like free annual blood work, eye and dental check-ups.

How can I top up my family's card from the UK?

Tap “Add money” on their card in your Seva Money app, enter the amount, and complete payment. You can use any Indian card, UPI, or bank account for top-ups.

We’ve also partnered with Nala to help you make international transfers. Sign up with Nala using the code in your Seva Money app, and save £20 off your first transfer of £50 or above. Once the money reaches your Indian bank account, you can use it to top up your parents’ Seva card from your Seva Money app.

What if my family needs emergency money or healthcare

For money: Instant card top-up available 24/7.

For healthcare: Our emergency helpline operates round-the-clock in 13 languages, with immediate hospital arrangements when needed.

Can I cancel if Seva doesn't work for us?

You can cancel anytime. All benefits will remain active until the end of the subscription period.

Stay connected with Seva

Get the latest updates, special offers, and insights on how Seva is transforming financial support and healthcare for families back home.

The only card for your parents in India with free healthcare benefits and curated savings from India’s top companies